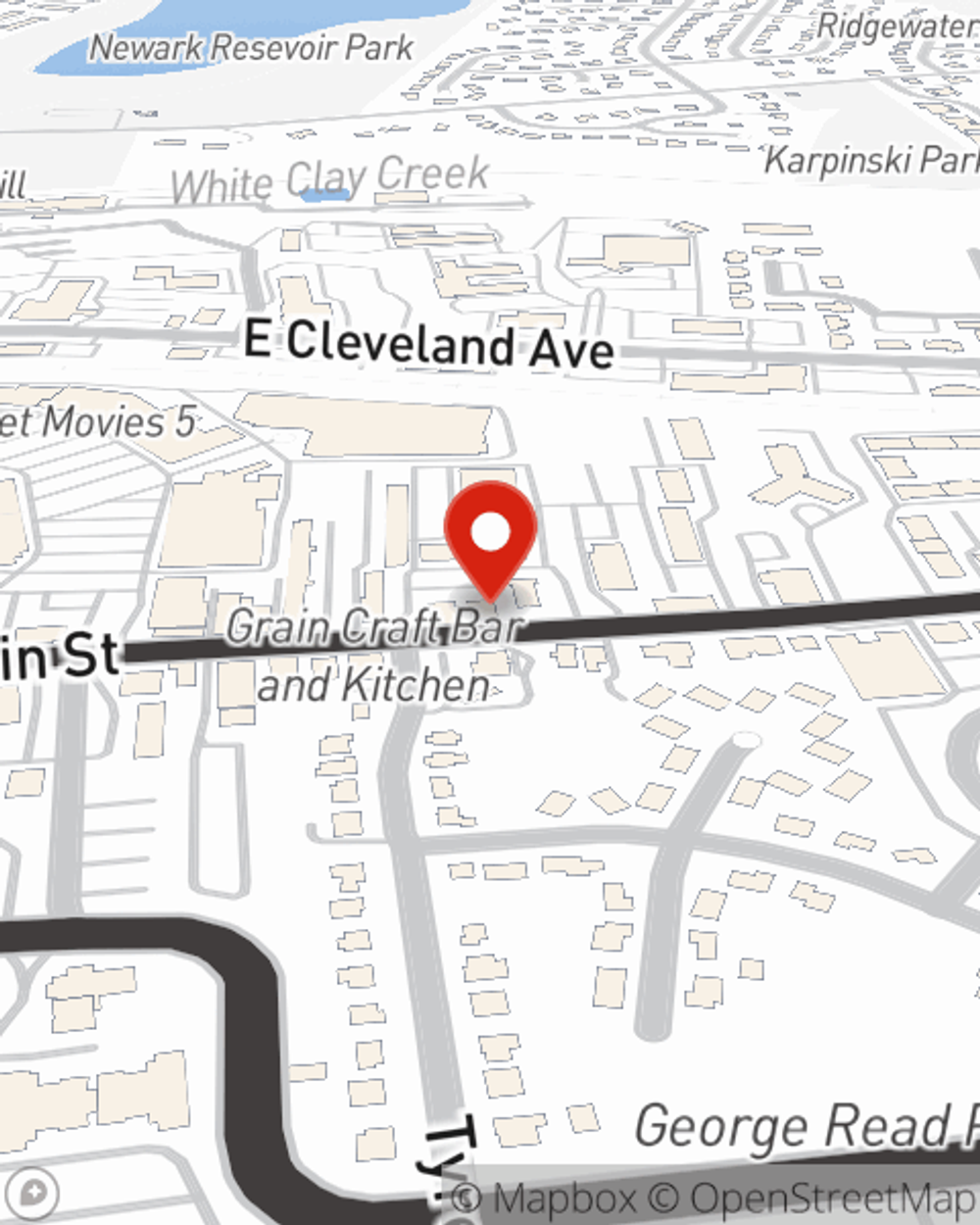

Insurance in and around Newark

Looking for insurance, neighbors of Newark?

Protect what matters most

Would you like to create a personalized quote?

- Newark

- Wilmington

- New Castle

- Hockessin

- Middletown

100 Years Of Good Neighboring Experience

We can help you create a Personal Price Plan® to help protect what’s important to you – family, things and your bottom line. From safe driving rewards, bundling options and discounts*, construct your coverage to meet your unique needs. Contact David Rosengarten for a Personalized Price Plan.

Looking for insurance, neighbors of Newark?

Protect what matters most

Our Broad Range Of Insurance Options Are Outstanding

Some of these excellent options include Life, Renters, Pet and RV insurance. Not only is State Farm insurance a great value, but it's a smart choice.

Simple Insights®

What to include in an emergency kit

What to include in an emergency kit

Having emergency kit supplies prepared ahead of time may give you the resources you and your family need to stay safe.

Understanding the insurance premium audit process

Understanding the insurance premium audit process

As a business owner, you may be contacted to complete an insurance premium audit. Learn what the insurance audit process entails and how to prepare.

David Rosengarten

State Farm® Insurance AgentSimple Insights®

What to include in an emergency kit

What to include in an emergency kit

Having emergency kit supplies prepared ahead of time may give you the resources you and your family need to stay safe.

Understanding the insurance premium audit process

Understanding the insurance premium audit process

As a business owner, you may be contacted to complete an insurance premium audit. Learn what the insurance audit process entails and how to prepare.